who pays sales tax when selling a car privately in michigan

In addition to use tax youll be responsible. The VIN number on the vehicle and the VIN on the title must match.

Free Vehicle Private Sale Receipt Template Word Pdf Eforms

For example when you purchase a used vehicle from an individual there is no sales tax involved so the state instead charges a use tax.

. However if you bought it for 14000 and sold it for 15000 earning a 1000 capital gain you would report this on your tax return using Schedule D on Form 1040 thats appropriately titled Capital Gains and Losses The form will instruct on you needed information. MOTOR VEHICLE UNDERSTATED VALUE PROGRAM. Michigan collects a 6 state sales tax rate on the purchase of all vehicles.

Dealers must submit the collected tax to the Secretary of State with their RD-108 Michigan Application for Title and Registration and statement of vehicle sale. Will I have to pay tax when transferring the title into my name. You will pay it to your states DMV when you register the vehicle.

But permits valid 30 days cost 10 of the annual registration fee or 20 whichever is higher. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the. For sales beginning on or after January 1 2019 an Ohio motor vehicle dealer selling to a Michigan resident should calculate the tax due based on the specifically stated or modified trade-in allowance that is authorized to be collected in Michigan.

Sales tax is charged every time a vehicle is bought or sold regardless of sales tax paid by a previous buyer. The tax rate is 6 of the purchase price or the retail value at the time of transfer whichever is greater. Partly in response to the rise in odometer fraud cases across the country the National Highway Traffic Safety Administrations NHTSA odometer disclosure requirements were updated in December 2020 impacting certain private vehicle sales in Michigan.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. It depends on the length of the permit. When sales tax is due the amount levied is 6 of the full purchase price of the vehicle.

If a vehicle is purchased privately the sales tax must be paid at a branch when you apply for the Indiana certificate of title. And permits valid 60 days cost 20 of the annual registration fee or 40 whichever is more. Based on this comparison when the reported sales price is less than the NADA value the Michigan Treasury will send a series of notices with the intent of either supporting the reported price or collecting the.

However the Toyota Financial Service TFS will only let me buy it and then I have to sell it myself. You dont need to pay the tax to the vehicle dealer or private party when buying the used vehicle but you need to pay it when registering with the DMV in your home state. The buyer will have to pay the sales tax when they get the car registered under their name.

However you do not pay that tax to the car dealer or individual selling the car. You would not have to report this to the IRS. A use tax is charged in the absence of a sales tax.

But unlike a sales tax which is based on purchase price a use tax is based on a vehicles fair market value. In order to ensure a smooth transition for retailers whose only obligation to collect Michigan sales tax comes from these new standards a remote seller must register and pay the Michigan tax beginning with transactions occurring on or after October 1 2018 or the calendar year after the threshold of over 100000 in Michigan sales or 200 transactions with Michigan customers is. The 6 percent use tax isnt charged when transferring the vehicle title to any of the following.

For vehicles that are being rented or leased see see taxation of leases and rentals. Dealers must have a sales tax license issued by the Michigan Department of Treasury. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve.

Hi I am planning to sell my leased vehicle as its market value is about 1500 higher than my buyout price. Do not let a buyer tell you that you are supposed to. Additionally if you buy a used car instead of a new one you must still pay a sales tax.

The buyer must pay any sales taxes when the new title is applied for or provide proof that the sales taxes have been paid. Although the Secretary of State collects 6 tax when the title is transferred final determination of the tax owed on vehicle transfers is made by the Michigan Department of Treasury. If Treasurys determination of tax liability differs from the amount collected when the title was.

Expect to pay these fees to a motor vehicle service center when transferring ownership. When purchasing or selling used vehicles including motorcycles in Pennsylvania many taxpayers are unaware that sales tax due to the Department of Revenue is a percentage of the fair market value of a vehicle rather than a percentage of the purchase price. You would come to an agreement for the purchase price of the vehicle with the private seller and when the payment is made the seller will sign the title of the vehicle into your name.

In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Yes - under Michigan tax law relationships that qualify for tax exempt status are limited to vehicles purchased or acquired from a spouse father mother child brother half-brother sister half-sister grandparent grandchild legal ward or legally-appointed guardian. Spouse father mother child brother half-brother sister half-sister grandparent grandchild legal ward or legally appointed guardian.

Proof of Ownership Buyers should ask to see the title to verify VIN and ownership. Also included are stepparents stepbrothers stepsisters stepchildren father-in-law mother-in-law brother-in-law sister-in-law son-in. Indiana residents who purchased a vehicle from a.

If I do that I will have to pay the tax to own this vehicle myself first and then the person buying it from me will also pay the tax. For a vehicle transfer that occurs from January 1 2021 through December 31 2030 any. Remember the sales price does not include sales tax or tag and title fees.

In addition to taxes car purchases in Michigan may be subject to other fees like registration title and plate fees. If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid State Form 48842. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax.

Under Michigan law the use tax payable on a used vehicle transfer is 6 on the greater of the purchase price or the retail value of the vehicle at the time of transfer. Several examples of exceptions to this tax are vehicles which are sold specifically to relatives of the seller certain types of equipment which is used in the agricultural business or some types of industrial machinery. Proof of Sale Once a car is sold between parties in Michigan the seller is protected from any damages caused by the.

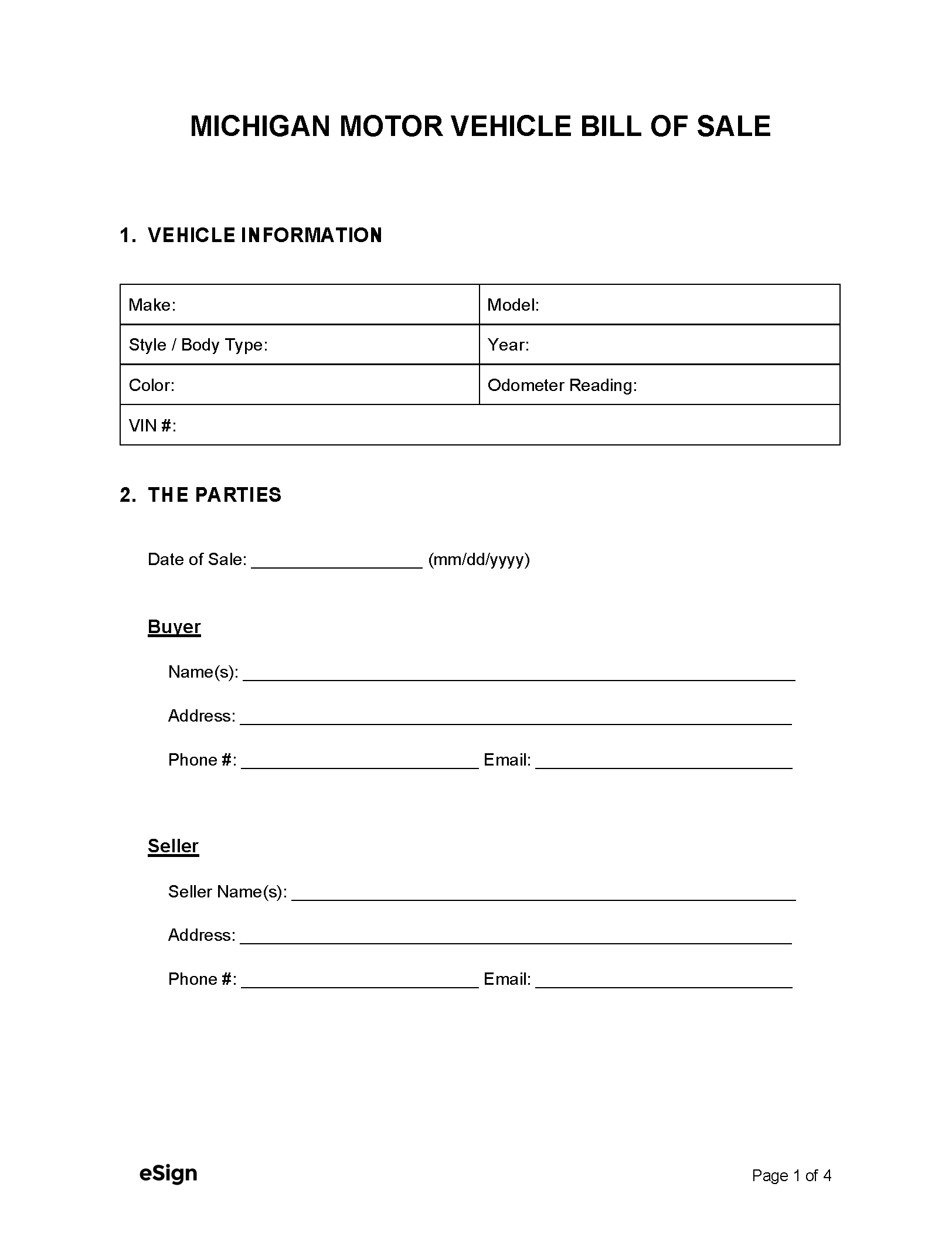

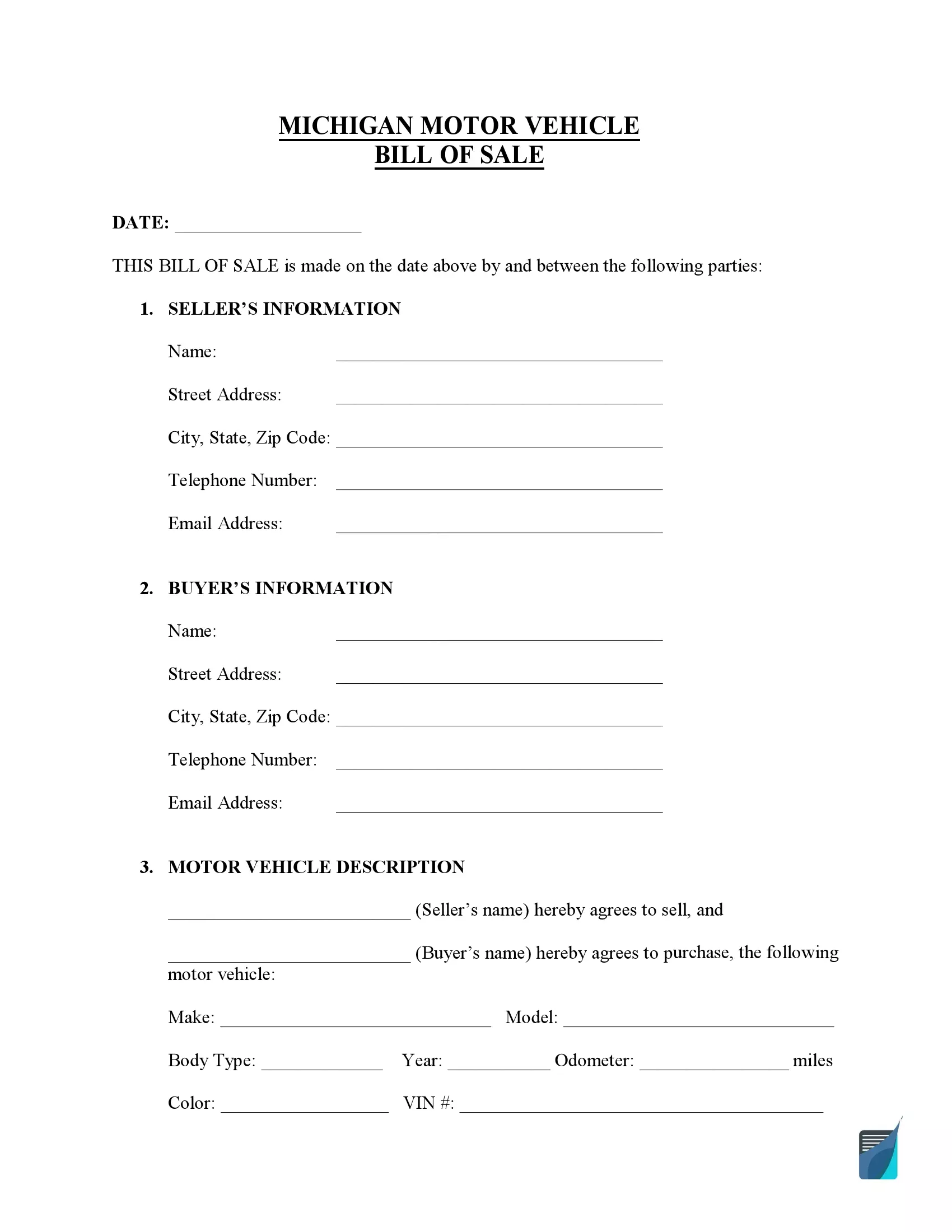

Free Michigan Motor Vehicle Dmv Bill Of Sale Form Pdf

![]()

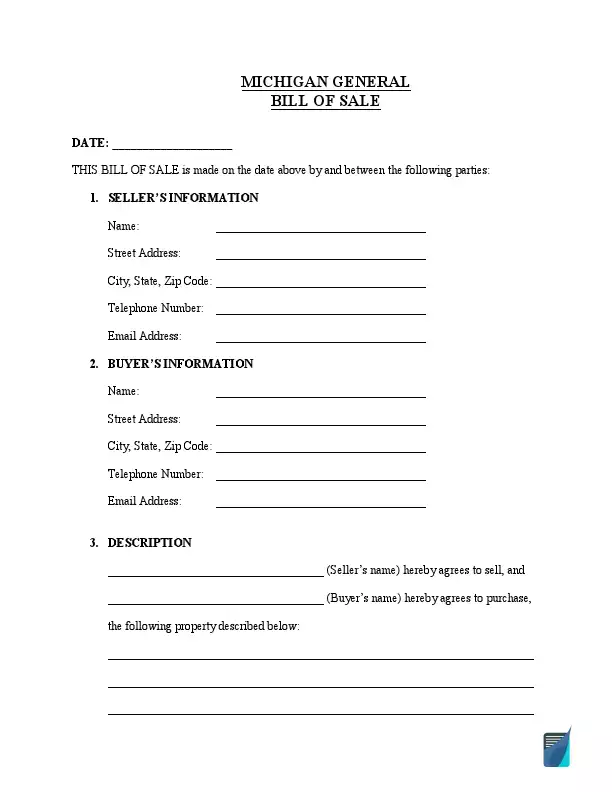

Free Michigan Bill Of Sale Forms Pdf Word

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

How To Transfer A Car Title In Michigan Yourmechanic Advice

Free Michigan Bill Of Sale Forms Pdf Word

How To Sell A Car In Michigan What The Sos Needs From Sellers

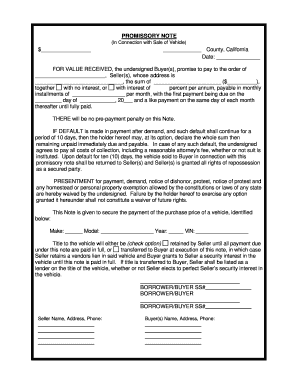

13 Printable Vehicle Purchase Agreement With Monthly Payments Forms And Templates Fillable Samples In Pdf Word To Download Pdffiller

Free Michigan Bill Of Sale Forms Mi Bill Of Sale Templates

Free Michigan Bill Of Sale Forms Mi Bill Of Sale Templates

Michigan Title Transfer Seller Instructions Youtube

What S The Car Sales Tax In Each State Find The Best Car Price

Michigan Sales Tax Small Business Guide Truic

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Michigan Bill Of Sale Forms Information You Need To Create A Bill Of Sale

/buying-a-car-in-a-different-state-4148015-Final2-1a901895477c4c518d48407644568ce8.png)

Tips For Buying A Car In A Different State

Free Michigan Bill Of Sale Form Pdf Template Legaltemplates

Michigan Sales Tax On The Difference For Trade Ins Means More Money For You